Decoding LLCs: Which Businesses Thrive Under This Structure?

Ever wondered what the buzz around LLCs is all about? You see the acronym everywhere, from small startups to established enterprises. But what kinds of businesses actually operate as LLCs, and why? This comprehensive guide dives deep into the world of limited liability companies, exploring which business structures thrive under this popular designation.

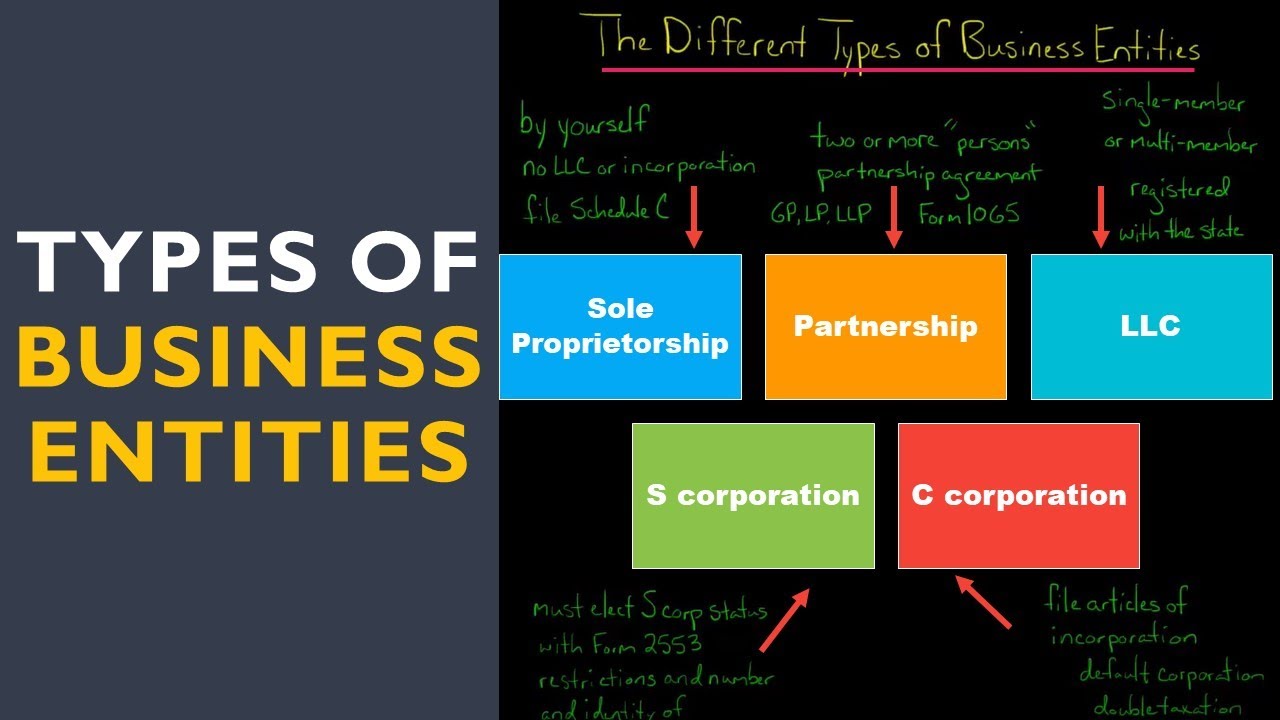

An LLC, or limited liability company, offers a unique blend of benefits, combining the personal liability protection of a corporation with the pass-through taxation of a partnership or sole proprietorship. This hybrid structure makes it an appealing choice for a wide range of ventures. But understanding if an LLC is the right fit for *your* business requires a closer look at its nuances.

So, what types of businesses are LLCs? The answer is surprisingly diverse. From single-member freelancers to multi-partner firms, the LLC structure can accommodate a variety of operational models. Common examples include consulting firms, real estate businesses, online retailers, and creative agencies. Essentially, any business seeking a balance of legal protection and tax efficiency could potentially benefit from incorporating as an LLC.

The history of the LLC begins in Wyoming in 1977, offering a new alternative to traditional business structures. Its popularity surged as other states adopted similar legislation, recognizing the advantages it offered entrepreneurs and small businesses. One of the most significant advantages of an LLC is the separation of personal and business liabilities. This means personal assets are generally protected from business debts and lawsuits, a crucial consideration for business owners.

A key issue to consider with LLCs is the varying regulations across different states. While the core principles remain consistent, the specific requirements for formation and maintenance can differ. This necessitates careful research and adherence to the specific rules of the state where your LLC is established.

Let's look at some examples. A freelance graphic designer operating as an LLC can protect their personal assets from potential client lawsuits. A multi-partner real estate investment firm structured as an LLC can streamline tax reporting while shielding individual partners from liability. A small e-commerce business using an LLC can benefit from the flexible management structure while minimizing personal financial risk.

Three key benefits of structuring your business as an LLC include: Limited Liability: Personal assets are generally protected from business debts and lawsuits. Pass-through Taxation: Profits and losses are reported on individual tax returns, avoiding the double taxation often associated with corporations. Flexibility: LLCs offer operational flexibility in terms of management structure and membership.

Creating an action plan for forming an LLC involves choosing a business name, filing articles of organization with the state, creating an operating agreement, and obtaining necessary licenses and permits.

Advantages and Disadvantages of LLCs

| Advantages | Disadvantages |

|---|---|

| Limited Liability | Limited Life in Some States |

| Pass-Through Taxation | Varying State Regulations |

| Flexibility | Less Established Legal Precedent |

Five best practices for LLCs include maintaining meticulous records, holding regular member meetings, keeping personal and business finances separate, staying compliant with state regulations, and seeking professional advice when needed.

Five real-world examples of LLCs include independent consultants, online retailers, real estate investment groups, marketing agencies, and small manufacturing businesses.

Five common challenges faced by LLCs include navigating complex state regulations, managing member disagreements, ensuring proper tax reporting, understanding liability limitations, and raising capital. Solutions include seeking professional guidance, drafting a comprehensive operating agreement, utilizing accounting software, staying informed about legal updates, and exploring alternative funding options.

FAQs

What is an LLC? An LLC is a business structure that offers limited liability and pass-through taxation.

How do I form an LLC? File articles of organization with your state.

What are the benefits of an LLC? Limited liability, pass-through taxation, and flexibility.

What are the disadvantages of an LLC? Limited life in some states and varying state regulations.

What types of businesses can be LLCs? Many, including consultancies, retailers, and real estate firms.

Do I need an operating agreement? It's highly recommended.

How are LLCs taxed? Profits and losses are reported on individual tax returns.

Where can I find more information on LLCs? Consult your state's Secretary of State website or the SBA.

Tips for a successful LLC include careful planning, thorough record-keeping, and ongoing compliance with state regulations. Understanding the unique advantages and potential challenges of the LLC structure is crucial for maximizing its benefits.

In conclusion, understanding which businesses thrive as LLCs is about recognizing the core benefits of this versatile structure. From limiting personal liability to simplifying tax reporting, the LLC offers a compelling alternative to traditional business models. By carefully considering your business needs and adhering to best practices, you can leverage the power of the LLC to achieve your entrepreneurial goals. Whether you're a freelancer, a small business owner, or part of a larger partnership, understanding the nuances of the LLC can pave the way for long-term success. Do your research, consult with professionals, and embark on your business journey with confidence. The flexibility and protection afforded by the LLC structure can be a game-changer for businesses of all sizes and industries, providing a solid foundation for growth and stability in today's dynamic market.

Safe acid disposal a comprehensive guide

Art lees dry fly trout fishing a refined approach

Elk river mn a water park oasis lets dive in