Decoding Wells Fargo Check Deposit Limits

Ever deposited a hefty check and wondered if there's a ceiling? You're not alone. The world of check deposit limits can seem like a labyrinth of rules and regulations. Understanding Wells Fargo's check deposit limits is crucial for managing your finances effectively, whether you're a small business owner, a freelancer, or just an individual managing personal finances.

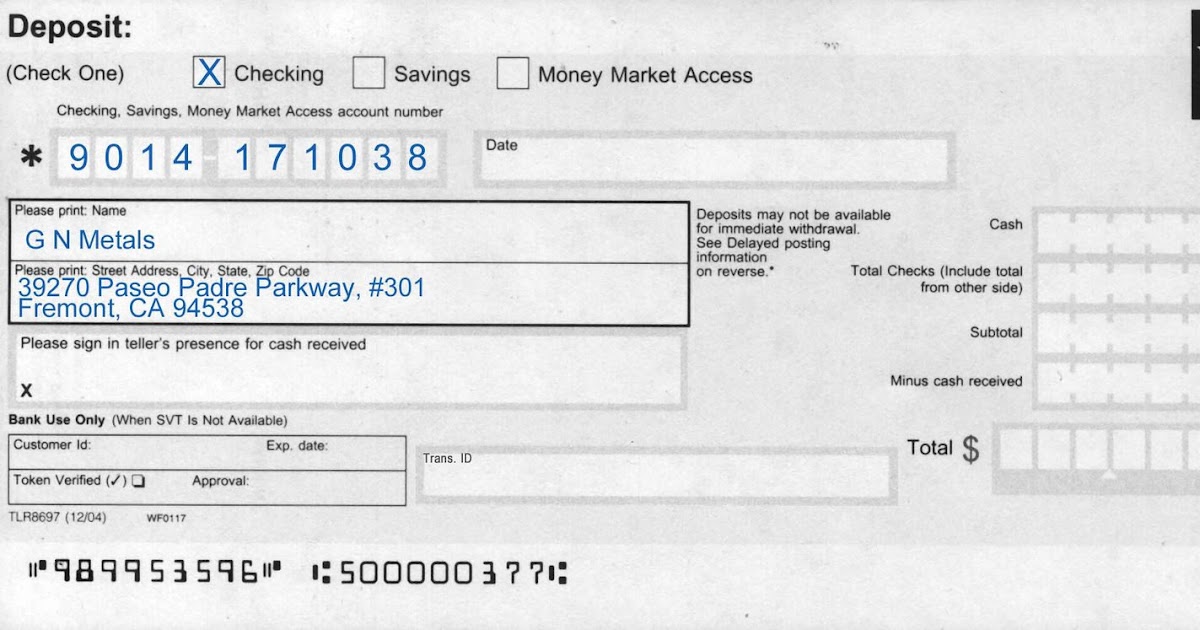

Wells Fargo, like most financial institutions, imposes limits on the amount of money you can deposit via check at a time. These constraints aren't arbitrary; they're designed to mitigate risks associated with fraud and money laundering. But navigating these restrictions can be tricky, especially if you're dealing with large sums or frequent deposits.

The specific Wells Fargo check deposit limit can vary. Factors influencing these restrictions can include your account type, account history, and the method of deposit (mobile deposit, ATM deposit, in-branch deposit). This makes it essential to be aware of your specific deposit allowance to avoid potential holds or delays in accessing your funds.

Mobile check deposit limits at Wells Fargo are often lower than those for in-branch deposits. This is largely due to the increased security risk associated with remote deposits. While mobile deposits offer incredible convenience, understanding the applicable limits is key to avoiding frustration.

Knowing the Wells Fargo daily deposit limit is also important, as exceeding this threshold can trigger holds on your funds. While the exact amount can fluctuate based on individual account specifics, being aware of this limitation allows you to strategize your deposits and avoid potential access delays.

The history of check deposit limits is intertwined with the evolution of banking security measures. As check fraud became more sophisticated, banks implemented stricter controls on deposit amounts to protect both themselves and their customers. The rise of mobile banking further complicated matters, leading to distinct limits for various deposit methods.

Wells Fargo’s check deposit policies play a vital role in maintaining the security and integrity of financial transactions. These limits help prevent fraudulent activities and ensure the stability of the banking system. For customers, understanding these limits helps manage expectations and avoid unexpected holds on deposited funds.

Navigating these limits efficiently involves a few key strategies. Firstly, know your limits. Check with Wells Fargo directly or access your account information online to understand your specific deposit allowance. Secondly, plan your deposits. If you anticipate depositing large sums, consider breaking them into smaller, more manageable transactions over several days. Lastly, leverage alternative deposit methods. If you encounter limitations with mobile deposits, consider utilizing ATM deposits or visiting a branch.

Advantages and Disadvantages of Wells Fargo Check Deposit Limits

| Advantages | Disadvantages |

|---|---|

| Increased security against fraud | Can be inconvenient for large deposits |

| Protects the financial system's integrity | May require multiple transactions |

Frequently Asked Questions:

1. What is the Wells Fargo mobile check deposit limit? This varies based on individual account factors. Contact Wells Fargo for specifics.

2. What is the daily deposit limit at Wells Fargo? This also depends on your account. Check your account details for information.

3. What happens if I exceed the deposit limit? Your funds may be placed on hold.

4. How can I find out my specific deposit limit? Contact customer service or check your online account information.

5. Are ATM deposit limits the same as mobile deposit limits? Not necessarily. They can differ.

6. Can I increase my deposit limit? Potentially, contact Wells Fargo to inquire about options.

7. Are there fees associated with exceeding the deposit limit? Generally, no, but holds on funds can cause inconvenience.

8. How does Wells Fargo determine individual deposit limits? This is based on a variety of factors, including account history and type.

Tips and Tricks: Keep track of your deposits, plan ahead, and consider breaking large checks into smaller deposits.

In conclusion, understanding Wells Fargo check deposit limits is a vital part of managing your finances effectively. These limits, while sometimes seemingly inconvenient, play a critical role in safeguarding the banking system and protecting your funds from fraud. By being aware of your specific limits, planning your deposits strategically, and leveraging alternative deposit methods when necessary, you can navigate these restrictions smoothly and ensure timely access to your money. Taking proactive steps to understand and work within these parameters will empower you to manage your finances with confidence and avoid potential frustrations. Remember, knowing your limits is the first step to maximizing your financial control. Contact Wells Fargo today to learn more about your specific deposit allowances and explore solutions tailored to your banking needs. Don't let uncertainty hold you back – take control of your finances today!

The ler evolution and its big tree origins

Mastering water temperature with relay control

Trailer bolt pattern mysteries decode your wheels