Mastering Accounting Worksheets: A Simple Guide

Ever felt overwhelmed by the complexities of financial record-keeping? It's a common experience, especially when faced with the seemingly daunting task of completing accounting worksheets. But fear not, this process, central to understanding your financial health, can be broken down into manageable steps. This guide aims to demystify the process and equip you with the knowledge to confidently approach any accounting worksheet.

Understanding how to populate an accounting worksheet (or "como llenar una hoja de trabajo contabilidad" in Spanish) is a fundamental skill for anyone involved in financial management, from small business owners to seasoned accountants. These worksheets serve as a crucial bridge between raw financial data and the formal financial statements that provide a snapshot of a business's financial health. They act as an organized space to gather, adjust, and summarize financial information before it's transferred to official reports.

The historical roots of accounting worksheets can be traced back to the earliest forms of bookkeeping. As businesses evolved, so did the need for more structured methods of recording financial transactions. The modern worksheet emerged as a tool to simplify the process of preparing financial statements, minimizing errors and streamlining the workflow. The core principle remains the same: to provide a clear and organized framework for summarizing financial activity.

The importance of accurately completing these worksheets cannot be overstated. They are essential for ensuring the accuracy of financial statements, which in turn inform crucial business decisions. Errors in worksheets can ripple through the entire accounting process, leading to misrepresented financial performance and potentially flawed strategic choices. Mastering this process allows for a clearer understanding of a company's financial position and provides the foundation for sound financial planning.

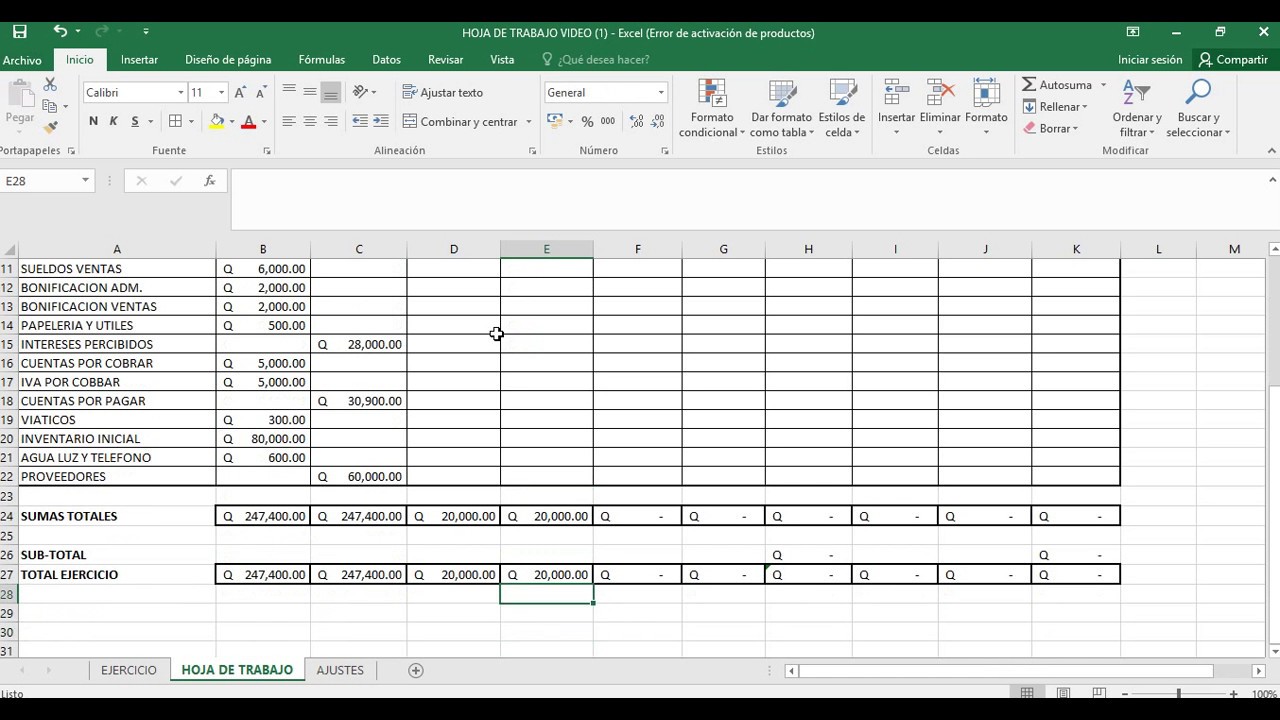

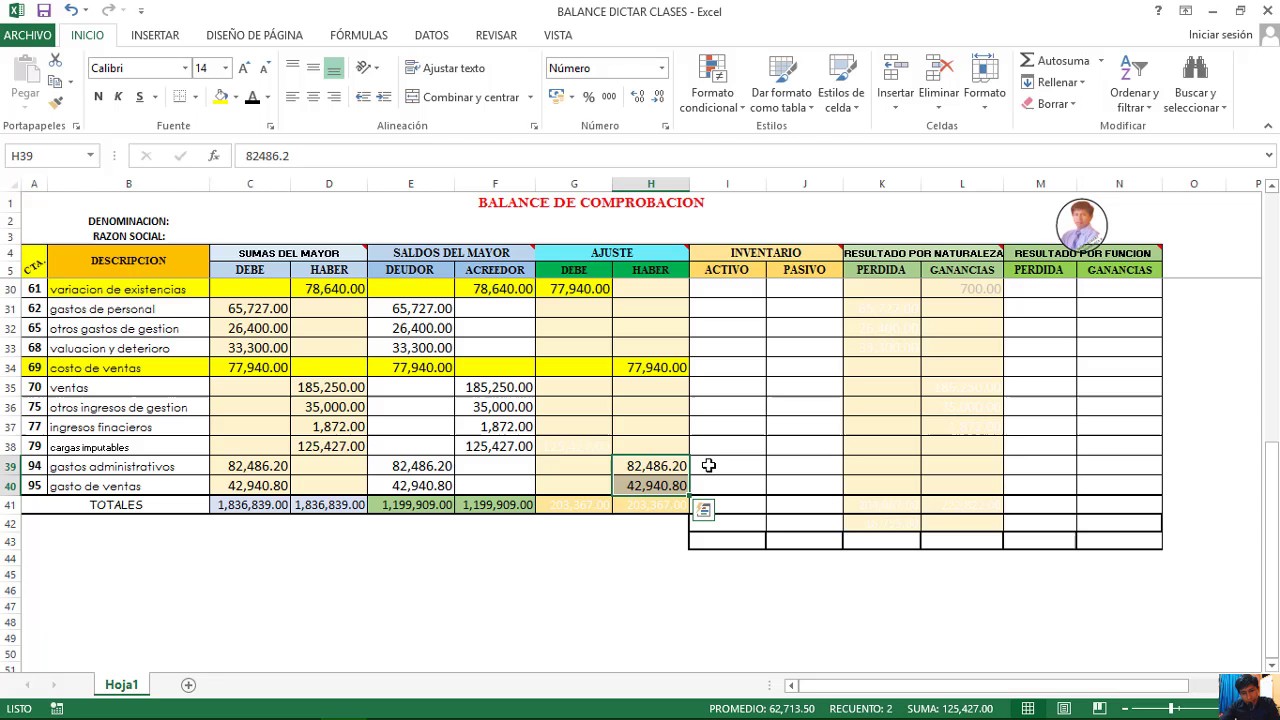

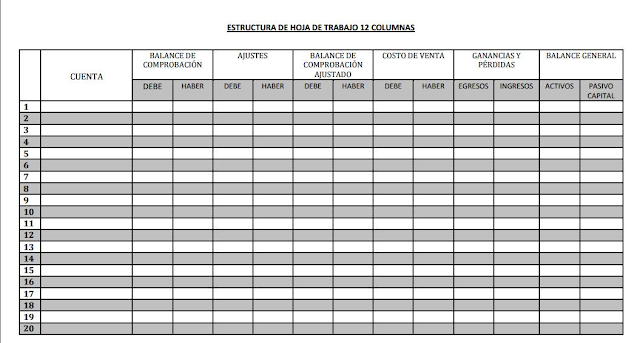

The key to understanding accounting worksheets lies in grasping the underlying structure. They are typically divided into columns representing different categories of financial data, such as assets, liabilities, equity, revenues, and expenses. The process involves systematically entering financial data into the appropriate columns and then making adjustments to account for accruals, deferrals, and other factors that impact the financial picture. This structured approach ensures a comprehensive and accurate reflection of the business's financial activities.

One benefit is improved accuracy in financial reporting. By providing a structured format, worksheets minimize the risk of errors that can occur when transferring data manually. Another advantage is streamlined financial statement preparation. Worksheets simplify the process of compiling data, reducing the time and effort required to generate financial statements. Furthermore, they facilitate analysis and interpretation of financial data. By organizing information in a clear and concise manner, worksheets enable users to easily identify trends and patterns, providing valuable insights into the business's financial performance.

A simple example: imagine a small business that has earned revenue but hasn't yet received payment. This unearned revenue would be recorded on the worksheet as a liability until the payment is received, at which point it would be reclassified as revenue. This process of adjustment ensures that the financial statements accurately reflect the business's financial position at any given time.

Start by gathering all necessary financial data, including trial balance information, adjusting entries, and any other relevant documentation. Then, carefully enter the data into the appropriate columns of the worksheet, ensuring accuracy and consistency. Finally, review and verify all entries before transferring the summarized information to the formal financial statements. Double-checking your work is crucial to maintaining accurate records.

Tips and Tricks: Use a consistent numbering system for accounts. Leverage spreadsheet software for automated calculations. Regularly review and reconcile your worksheet data.

Mastering the art of completing accounting worksheets is not about memorizing complex procedures. It's about understanding the underlying principles and applying them with diligence and attention to detail. This empowers you to confidently navigate the complexities of financial record-keeping, gain deeper insights into your business's financial health, and make informed decisions that drive success. Embrace the process, and you’ll find that what once seemed daunting becomes a powerful tool for financial clarity and control.

Dominate fifa 23 ultimate team master the web app

Score a deal your guide to toyota rav4 hybrids near ithaca ny

The nine days queen lady jane grey