Revenue Generating Institutions: Exploring Their Impact

What fuels economic growth and stability? One crucial component often overlooked is the role of revenue-generating institutions. These organizations, often governmental or quasi-governmental, are the backbone of public funding, supporting essential services and infrastructure. From tax agencies to state-owned enterprises, understanding their function is key to grasping the dynamics of a nation's financial health.

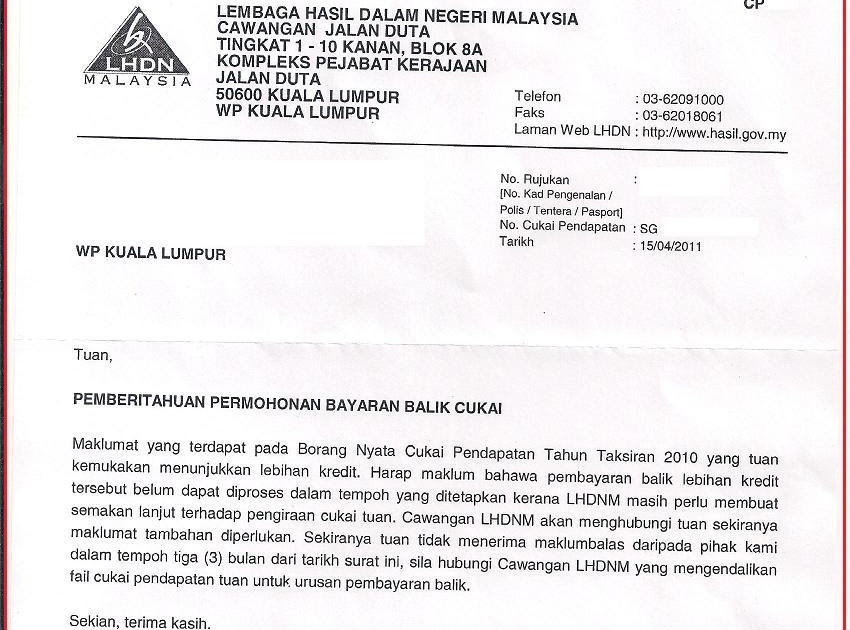

The term "lembaga hasil" in Indonesian directly translates to "revenue-generating institutions" in English. These bodies are diverse, encompassing everything from national tax collection agencies to organizations responsible for managing natural resources and generating income from them. Their impact ripples throughout society, influencing everything from education and healthcare to infrastructure development and social welfare programs.

The emergence of revenue-generating institutions is intertwined with the development of modern states. As societies became more complex, the need for centralized revenue collection became apparent. Early forms of these institutions can be traced back centuries, evolving alongside governance structures. Tax farming, for example, was a common practice where private individuals or groups were granted the right to collect taxes in exchange for a fixed payment to the ruler.

The importance of these institutions cannot be overstated. They provide the financial resources that allow governments to function. Without a stable revenue stream, governments struggle to provide essential public services, maintain infrastructure, and invest in future growth. This can lead to social unrest, economic instability, and a decline in the overall quality of life. Effectively managed revenue-generating institutions are the bedrock of a thriving society.

However, these institutions also face numerous challenges. Corruption, inefficiency, lack of transparency, and fluctuating global economic conditions can all impact their ability to generate revenue effectively. Addressing these issues is critical to ensuring long-term financial stability and sustainable growth.

A prime example of a revenue-generating institution is a national tax agency. This body is responsible for collecting various taxes, including income tax, corporate tax, and sales tax. The revenue collected is then used to fund government programs and services.

Another example is a state-owned enterprise that manages natural resources, such as oil or mineral deposits. The profits generated from the extraction and sale of these resources contribute to the national treasury.

Three key benefits of well-functioning revenue-generating institutions are: 1) Sustainable Funding for Public Services: Reliable revenue streams enable consistent funding for essential services like healthcare, education, and infrastructure. 2) Economic Stability: Predictable revenue collection contributes to macroeconomic stability and allows for long-term planning. 3) Economic Growth: Investment in infrastructure and social programs, fueled by revenue generation, fosters economic growth and development.

One real-world challenge faced by revenue-generating institutions is tax evasion. A solution to this is implementing stricter enforcement measures and promoting tax compliance through public awareness campaigns.

Advantages and Disadvantages of Revenue Generating Institutions

| Advantages | Disadvantages |

|---|---|

| Funds public services | Potential for corruption |

| Supports economic growth | Can be inefficient |

| Provides economic stability | Vulnerable to economic fluctuations |

Five best practices for these institutions include: 1) Transparency: Openly disclosing financial information builds public trust. 2) Accountability: Holding individuals and departments accountable for their performance. 3) Efficiency: Streamlining processes to minimize waste and maximize revenue collection. 4) Fairness: Implementing equitable tax policies. 5) Technology Adoption: Leveraging technology to improve efficiency and transparency.

Five real-world examples: 1) The Internal Revenue Service (IRS) in the United States. 2) Her Majesty's Revenue and Customs (HMRC) in the United Kingdom. 3) The Canada Revenue Agency (CRA). 4) The Australian Taxation Office (ATO). 5) Inland Revenue Department of New Zealand (IRD).

Five frequently asked questions: 1) What are revenue-generating institutions? Answer: Organizations tasked with collecting revenue for the government. 2) Why are they important? Answer: They fund essential public services. 3) What are the challenges they face? Answer: Corruption, inefficiency, etc. 4) How can they be improved? Answer: Through transparency, accountability, etc. 5) What are some examples? Answer: Tax agencies, state-owned enterprises. 6) How do they impact economic growth? Answer: They provide funding for infrastructure and social programs. 7) How can they promote economic stability? Answer: Consistent revenue collection enables long-term planning. 8) What role does technology play in their development? Answer: It can improve efficiency and transparency.

One tip for maximizing the effectiveness of revenue-generating institutions is to invest in training and development for employees to enhance their skills and knowledge.

In conclusion, revenue-generating institutions are vital for the functioning of any modern society. They provide the financial resources that support essential services, infrastructure development, and economic growth. While facing challenges such as corruption and inefficiency, these institutions can be strengthened through transparency, accountability, and the adoption of best practices. Effective revenue generation is crucial for long-term economic stability and prosperity. By understanding the importance of these institutions and actively working towards their improvement, we can contribute to a stronger and more sustainable future. Continued focus on best practices, addressing challenges proactively, and investing in innovation will be essential for these institutions to thrive in a constantly evolving global landscape. It is crucial for citizens to engage with these institutions, understand their functions, and advocate for responsible and effective revenue generation.

Unlocking the power of sw light french gray cabinets

Elevating your pocket universe a deep dive into 4k phone wallpapers

Masjid jamek kuala lumpur a historic gem