Understanding Medicare Part B Costs

Healthcare costs are a significant concern for many, especially as we approach retirement. Understanding Medicare, a crucial component of healthcare for those 65 and older, can feel like navigating a complex maze. One key piece of this puzzle is Medicare Part B, which covers essential medical services like doctor visits, outpatient care, and preventive services. But what’s the typical cost of Medicare Part B, and how can you plan for it?

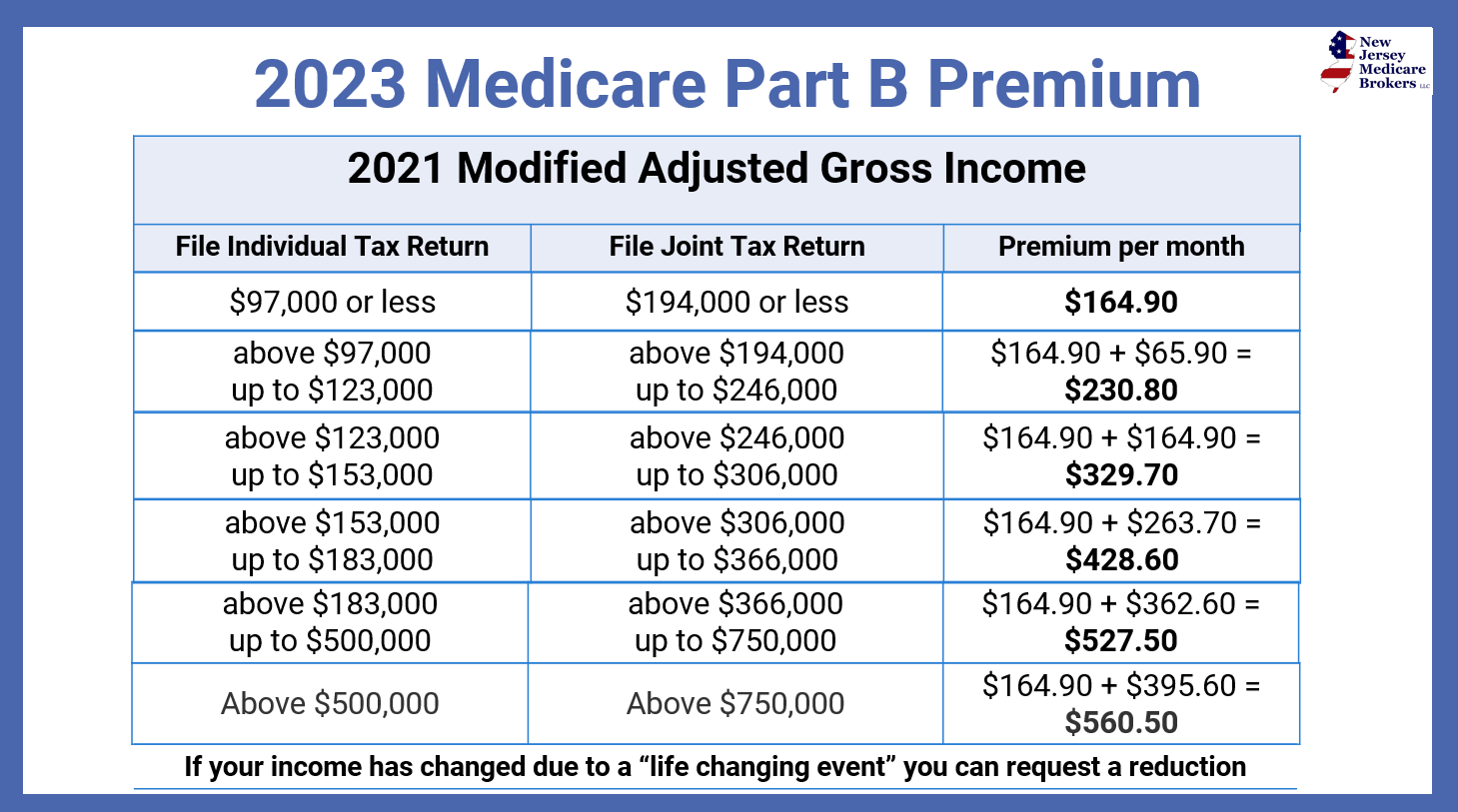

Medicare Part B premiums are a recurring expense, deducted directly from your Social Security benefits or billed quarterly. While the standard monthly premium provides a baseline, the actual amount you pay can vary based on your income. Higher earners may pay a larger share, known as an Income-Related Monthly Adjustment Amount (IRMAA). Understanding these adjustments and how they impact your overall expenses is essential for effective financial planning.

The history of Medicare Part B dates back to the enactment of Medicare in 1965. Initially, Part B was optional and required a separate premium. Over time, it has become an integral part of Medicare coverage for most beneficiaries, offering crucial access to medically necessary services outside of hospital settings. The importance of Part B lies in its coverage of routine doctor visits, preventive screenings, and outpatient treatments, all of which contribute to maintaining good health and managing chronic conditions.

One of the main issues surrounding Medicare Part B costs is the potential financial burden on beneficiaries, particularly those with fixed incomes. While the standard premium is generally affordable for many, the IRMAA can significantly impact higher earners. Furthermore, understanding the various deductibles, coinsurance, and copayments associated with Part B services is crucial for accurate budgeting and avoiding unexpected healthcare expenses.

Let's break down some key terms. The "Medicare Part B premium" is the regular monthly fee you pay for coverage. "Deductible" refers to the amount you must pay out-of-pocket before Medicare begins covering services. "Coinsurance" is the percentage of costs you share with Medicare after meeting your deductible, and "copayment" is a fixed dollar amount you pay for specific services.

Navigating Medicare Part B costs can be challenging, but several online resources can help. The official Medicare website (Medicare.gov) provides detailed information on premiums, deductibles, and coverage. Organizations like AARP and the National Council on Aging also offer helpful resources and guidance on Medicare.

Frequently Asked Questions:

1. What is the typical Medicare Part B premium? (Answer: The standard premium is adjusted annually. Check Medicare.gov for the current amount.)

2. How is the IRMAA calculated? (Answer: IRMAA is based on your modified adjusted gross income (MAGI) reported on your tax return.)

3. Does Medicare Part B cover all medical expenses? (Answer: No, Part B covers a portion of medically necessary services. There are still out-of-pocket costs like deductibles, coinsurance, and copayments.)

4. What if I can’t afford the Part B premium? (Answer: There are programs available to assist low-income individuals with Medicare costs. Contact your State Health Insurance Assistance Program (SHIP) for more information.)

5. How do I enroll in Medicare Part B? (Answer: You can typically enroll during your Initial Enrollment Period around your 65th birthday. Other enrollment periods may apply depending on your circumstances.)

6. Does Medicare Part B cover prescription drugs? (Answer: Generally, no. Prescription drug coverage is provided through Medicare Part D or Medicare Advantage plans.)

7. Can I appeal my IRMAA determination? (Answer: Yes, you can appeal if you believe your IRMAA is incorrect due to a life-changing event.)

8. How can I find out more about Medicare Part B costs specific to my situation? (Answer: Contact your local Social Security office or SHIP for personalized assistance.)

Tips for managing Medicare Part B costs: Review your coverage annually, compare Medicare Advantage plans if applicable, understand your out-of-pocket expenses, and consider supplemental insurance (Medigap) to help cover cost-sharing.

Understanding the typical cost of Medicare Part B is essential for anyone approaching Medicare eligibility. By taking the time to learn about premiums, deductibles, coinsurance, and available resources, you can approach retirement with greater financial confidence and ensure access to the healthcare services you need. Being proactive in your research and planning can help you make informed decisions about your Medicare coverage and budget effectively for future healthcare expenses. Don't hesitate to reach out to resources like Medicare.gov, SHIP, or AARP for personalized guidance. Your health and financial well-being are worth the effort.

Navigating the rutgers new brunswick academic calendar

Transforming new albany with sherwin williams paint

Beautiful spanish girl names a journey through meaning and culture