Understanding Medicare Plan B Costs

Navigating the complexities of healthcare can feel overwhelming, especially when trying to understand the costs associated with Medicare. One common question many beneficiaries have is, “How much is the Medicare Plan B premium?” Understanding this cost is crucial for effective financial planning and ensuring you have access to the necessary medical services.

Medicare Plan B, also known as medical insurance, covers crucial services like doctor visits, outpatient care, and preventive services. Unlike Part A (hospital insurance), Part B requires a monthly premium. This premium isn't static; it's subject to change annually and can vary based on your income.

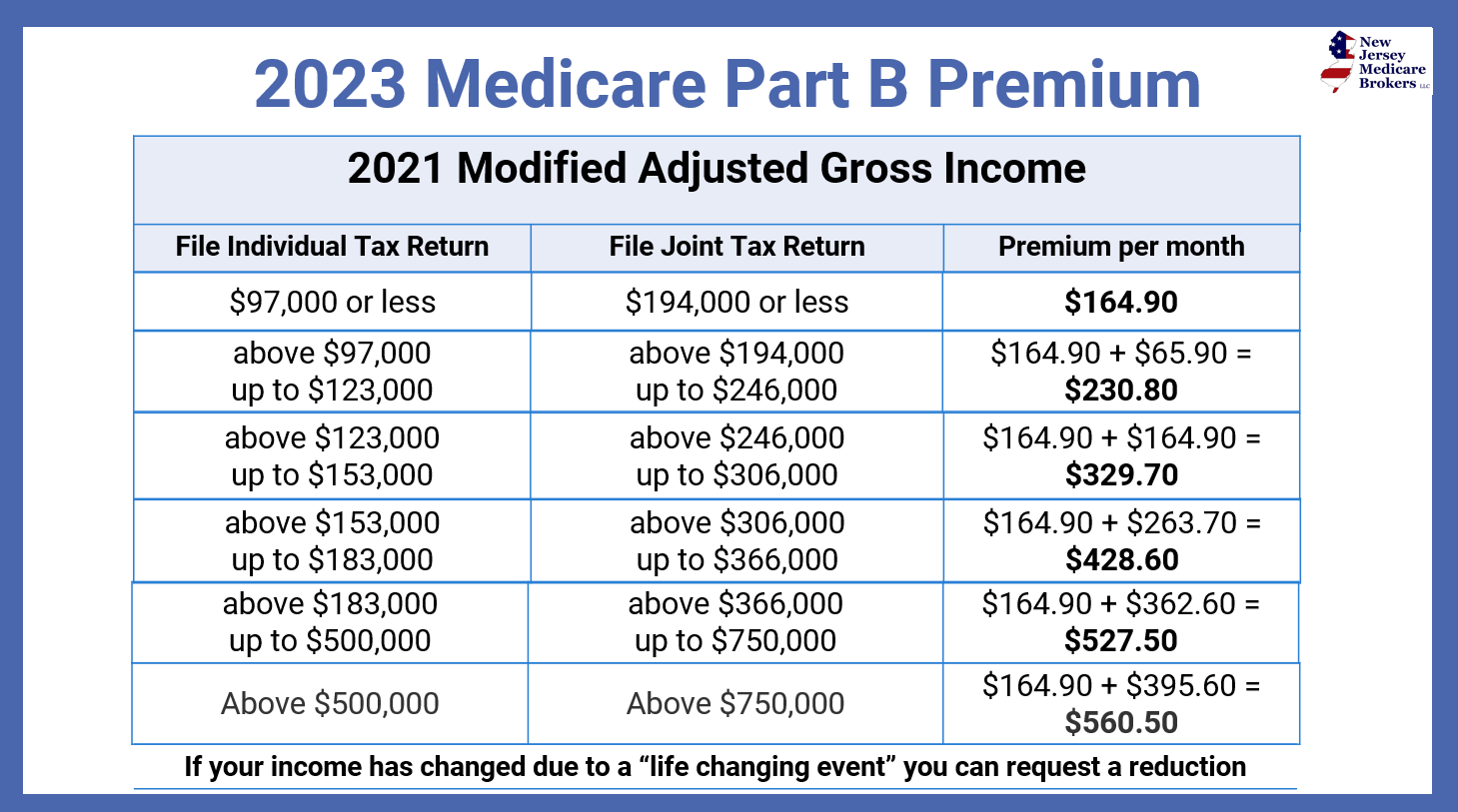

The standard Medicare Plan B premium is set each year by the Centers for Medicare & Medicaid Services (CMS). For 2024, the standard monthly premium is $164.90. This represents a decrease from the previous year. However, it's essential to remember that this is the standard premium, and the actual amount you pay could be higher based on your income.

Higher-income beneficiaries may pay a higher premium, known as the Income-Related Monthly Adjustment Amount (IRMAA). IRMAA is based on your modified adjusted gross income (MAGI) from two years prior. This means your 2024 premium is based on your 2022 income. The specific IRMAA tiers and corresponding premiums are available on the Social Security Administration website.

Understanding how much you'll pay for Medicare Plan B is an essential part of retirement planning. It allows you to budget effectively and avoid unexpected expenses. By incorporating these costs into your financial projections, you can maintain financial stability and peace of mind.

Medicare Part B, established in 1965 as part of the original Medicare legislation, has evolved significantly over time. Its purpose was to provide coverage for medically necessary services outside of hospital settings. Over the years, the range of covered services has expanded, reflecting advancements in medical care and the changing needs of beneficiaries. One of the ongoing challenges is balancing the costs of providing these essential services with affordability for beneficiaries, particularly those with limited incomes.

Knowing the Medicare Plan B premium empowers beneficiaries to make informed decisions about their healthcare coverage. It's crucial information for budgeting and planning for future medical expenses. This knowledge can also help beneficiaries understand the value of the services covered under Part B, such as doctor visits, outpatient care, and preventive screenings.

One benefit of understanding the Medicare Plan B premium is accurate budgeting. For example, if you know your monthly premium is $164.90, you can factor this into your monthly expenses. A second benefit is proactive planning for potential IRMAA surcharges. By being aware of the income thresholds for IRMAA, you can anticipate potential increases in your premiums. A third benefit is making informed decisions about supplemental coverage. Understanding your Part B costs can help you choose a Medigap plan or other supplemental insurance that best fits your needs and budget.

If you are nearing Medicare eligibility, start planning for your Part B premium costs by reviewing your income from two years prior. Visit the Social Security Administration website to understand the current premium and any applicable IRMAA surcharges. This allows you to incorporate these costs into your budget.

Advantages and Disadvantages of Understanding Plan B Premiums

| Advantages | Disadvantages |

|---|---|

| Better Budgeting | Complexity of IRMAA |

| Informed Decisions about Supplemental Coverage | Potential for Premium Increases |

Frequently Asked Questions (FAQs)

1. Where can I find the current Medicare Plan B premium? (Answer: The Social Security Administration website.)

2. How is IRMAA calculated? (Answer: Based on your modified adjusted gross income from two years prior.)

3. Can I appeal my IRMAA determination? (Answer: Yes, if you believe it's incorrect.)

4. When are Part B premiums deducted? (Answer: Usually from your Social Security benefits.)

5. What if I don't have Social Security benefits? (Answer: You'll receive a bill.)

6. What happens if I don't pay my premium? (Answer: Your coverage may be terminated.)

7. Can I change my Medicare Part B coverage? (Answer: You can during certain enrollment periods.)

8. Where can I get more information about Medicare Plan B premiums? (Answer: Contact Medicare directly or visit their website.)

Tips for managing your Medicare Plan B costs include staying informed about annual premium changes and reviewing your income regularly to anticipate potential IRMAA adjustments.

Understanding your Medicare Plan B premium is fundamental to navigating the healthcare landscape in retirement. Knowing how these costs are calculated, the factors that influence them, and available resources empowers you to plan effectively and make informed decisions about your healthcare coverage. By proactively addressing these costs, you can ensure access to necessary medical services without financial strain. Take the time to review your income, utilize online resources, and contact Medicare directly if you have questions. Planning for these costs today will contribute significantly to your financial well-being and peace of mind tomorrow.

Unveiling effective army leadership examples

Navigating the bahamian justice system insights into the department of corrections

Dominate march madness with expert ncaa bracket picks